Finance Minister Nirmala Sitharaman presented her seventh straight Budget today. With this, she broke the record of former Prime Minister Morarji Desai. She has presented some excellent Budgets during her tenure. The announcements made in today’s Budget were sort of a mixed bag from the perspective of investors and financial advisors. However, the government has hit the right spots in terms of focus areas of expenditure.

Fiscal Deficit target reduced

One of the best achievements of the Finance ministry under the current leadership is their track record on fiscal discipline. Fiscal deficit is the difference between the government’s total revenue and total expenditure. This helps in estimating how much the government will need to borrow to meet its planned expenditures. As per today’s Budget announcement, the fiscal deficit target for FY25 is pegged at 4.9% of GDP. This is much lower than the 5.1% target announced in the interim budget released in February. The government aims to bring down the fiscal deficit to 4.5% (or less) of GDP by FY26.

High Defence Allocation

Defence takes the top position in terms of expenditure – with a Rs. 4.5 lakh crore outlay. The

government also fully exempted customs duties on 25 critical minerals (like lithium, cobalt, copper, rare earth elements etc) which have applications in important sectors like defence, renewable energy, space, telecommunication and high-tech electronics.

Need of the hour: Emphasis on Employment

The word ‘employment’ featured 33 times in the Finance Minister’s Budget speech. This year the outlay for education, employment and skilling stands at Rs. 1.48 lakh crore. The Prime Minister’s package of 5 schemes and initiatives for 4.1 crore youth over the next 5 years has been allocated Rs. 2 lakh crore.

a. It is proposed that women workforce will be supported by setting up hostels and establishing creshes. We believe this is an important step in helping women enter the labour force.

b. Today many Indians aspire to launch their own startups and many have been founders of very

interesting ventures in recent times. The government under PM Modi has done significant amount of work over the years in bolstering the Indian startup ecosystem and supporting the entrepreneurial spirit. They have taken this one step further by abolishing the angel tax for all classes of investors. We think this is a very positive step. Startups not only foster innovation and development, they also in turn provide employment to many.

c. Skilling programme and upgradation of Industrial Training Institutes (ITIs) announced. 1,000 ITIs will be upgraded over the next 5 years.

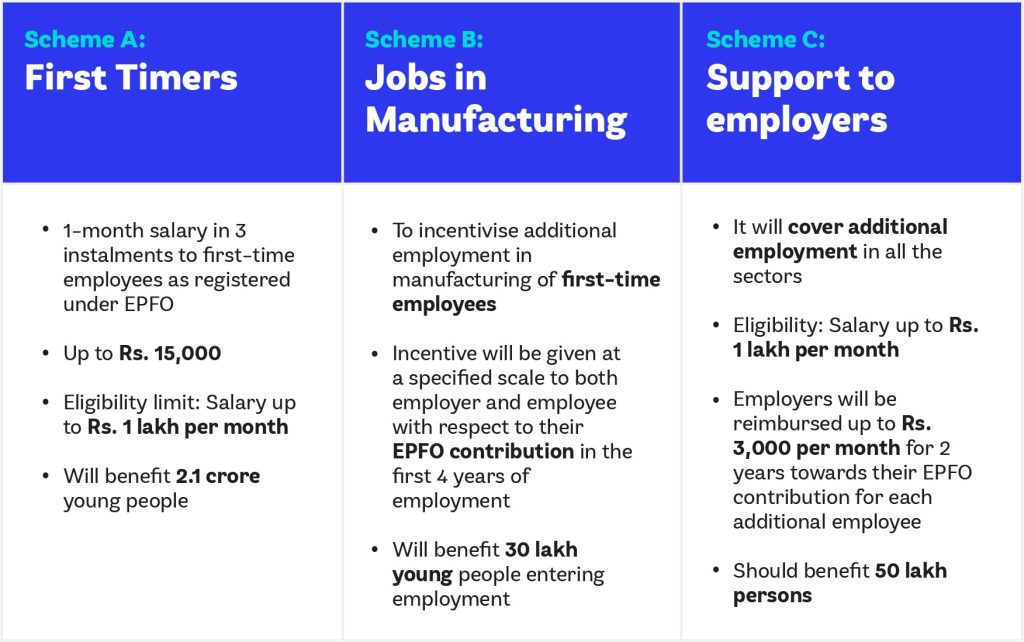

d. Three schemes announced for ‘Employment linked incentives’:

Focus on rural economy

Post-pandemic era saw India become the fastest-growing major economy. However, the rural part of India did not participate in his growth as much as urban India till FY24. The government’s focus on rural India is on expected lines – both from an economic and political perspective. A provision of Rs. 2.66 lakh crore has been made for rural development including rural infrastructure. Apart from this, Rs. 1.52 lakh crore has been set aside for agriculture and allied sectors.

- 109 new high-yielding and climate-resilient varieties of 32 field and horticulture crops will be

released for cultivation by farmers. - Phase IV of Pradhan Mantri Gram Sadak Yojana (PMGSY) will be launched to provide all-weather

connectivity to 25,000 rural habitations. - Some rural land-related announcements were made which will make it easier to provide credit

and other agri-services to the last mile

o Assignment of Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar for all

lands

o Digitization of cadastral maps

o Survey of map sub-divisions as per current ownership

o Establishment of land registry

o Linking to the farmers registry - Details of 6 crore farmers and their lands will be brought into the farmer and land registries. This

is a great step towards building public infrastructure for agriculture. - PM Awas Yojana: 3 crore additional houses in rural and urban areas of the country announced

- Jan Samarth based Kisan Credit Cards will be issued in 5 states.

Infrastructure Push continues

The government’s aggressive infrastructure projects have been a key driver of India’s growth. The continued momentum will have a multiplier effect on the economy. Rs. 11,11,111 crore has been earmarked for capital expenditure this year, which is 3.4% of GDP.

- Private sector investment in infrastructure will be promoted through viability gap funding and enabling policies and regulations

- Rs 1.5 lakh crore for long-term interest free loans to states to undertake large scale infrastructure projects

- Irrigation and flood mitigation support announced for Bihar, Assam, Himachal Pradesh, Uttarakhand and Sikkim

A lot changed for investors and taxpayers

The Finance Ministry has given a lot of importance to simplification of tax structures. Listed financial assets held for more than a year will be classified as long term, while unlisted financial assets and all non-financial assets will have to be held for at least two years to be classified as long-term. This is a positive as the holding period of bonds and gold has been reduced from 3 years to 2 years for classification as long-term.

| Lower on pocket | Higher on pocket | |

|---|---|---|

| Short Term Capital Gains | Short term gains of specific financial assets to attract 20% tax rate instead of the current 15% | |

| Long Term Capital Gains | – Long term gains on all non-financial assets to attract a tax rate of 12.5% instead of the current rate of 20% – Limit of exemption of capital gains on certain listed financial assets increased from ₹ 1 lakh to ₹ 1.25 lakh per year. | – Long term gains on all financial assets to attract a tax rate of 12.5% – Indexation benefit for calculating long term capital gains in case of assets like property and gold has been removed |

| Customs Duty | – Total import duty on gold and silver reduced from 15% to 6% – Customs duty on platinum reduced from 15.4% to 6.4% | |

| Futures & Options | – The Securities Transaction Tax (STT) on sale of futures increased from 0.0125% to 0.02% of the future’s trading price – STT on sale of options increased from 0.0625% to 0.1% of the option premium | |

| Buyback of shares | – Income from buyback of shares will be chargeable in the hands of the recipient as dividend, instead of the current system of additional income-tax in the hands of the company. The cost of such shares shall be treated as a capital loss to the investor. | |

| Angel Tax | – Abolished for all classes of investors |

Some relief for middle class as there is some revision in the income tax rates under the New Regime:

₹0-3 lakh – nil tax

₹3-7 lakh – 5%

₹7-10 lakh – 10%

₹10-12 lakh – 15%

₹12-15 lakh – 20%

Above ₹15 lakh – 30%

- Standard deduction to salaried individuals and pensioners is proposed to be increased from Rs. 50,000 to Rs. 75,000 under the new tax regime.

- Deduction from family pension of Rs. 15,000 is proposed to be increased to Rs. 25,000 under the new tax regime.

Our View

All in all, investors who invest in listed shares directly or through managed vehicles like mutual funds, will have to shell out relatively higher amounts as capital gains tax going forward. There is a bit of a relief by way of a higher exemption limit of Rs. 1.25 lakh for long term capital gains tax. For investors holding large portfolios, this relief may not mean much though. However, we still believe equities continue to be attractive for long term investors and even after the higher tax, will most likely provide the best opportunities to beat inflation and create wealth in the long run.